INFRASTRUCTURE FOR REAL-ASSET LIFECYCLES

The Real Asset Execution Rail

GTAI (Golden Thread as Infrastructure) compiles the conditions that define asset performance into enforceable logic at every state transition across the asset lifecycle.

P R O B L E MEvery lifecycle participant reconstructs what the last one produced

Real estate is the world’s largest asset class. It operates without shared execution infrastructure. The conditions that define how an asset should perform cannot travel intact across capital, ownership, operations and assets.

Every transition loses what the last one produced. The mandate becomes a brief. The brief becomes a design. The design becomes a contract. The contract becomes an operational baseline. At every transition, conditions are re-established as if they never existed.

At disposal, due diligence reconstructs a lifecycle of decisions from fragments, because in any verifiable form that history does not exist.

Every successive wave of technology adds intelligence to a system that has no way to act on it, because the medium those decisions live in cannot retain, compound or scale across assets, lifecycles and geographies.

G O L D E N T H R E A DThe Golden Thread is a canonical, append-only record of every decision, verification, exception and state change across the asset lifecycle.

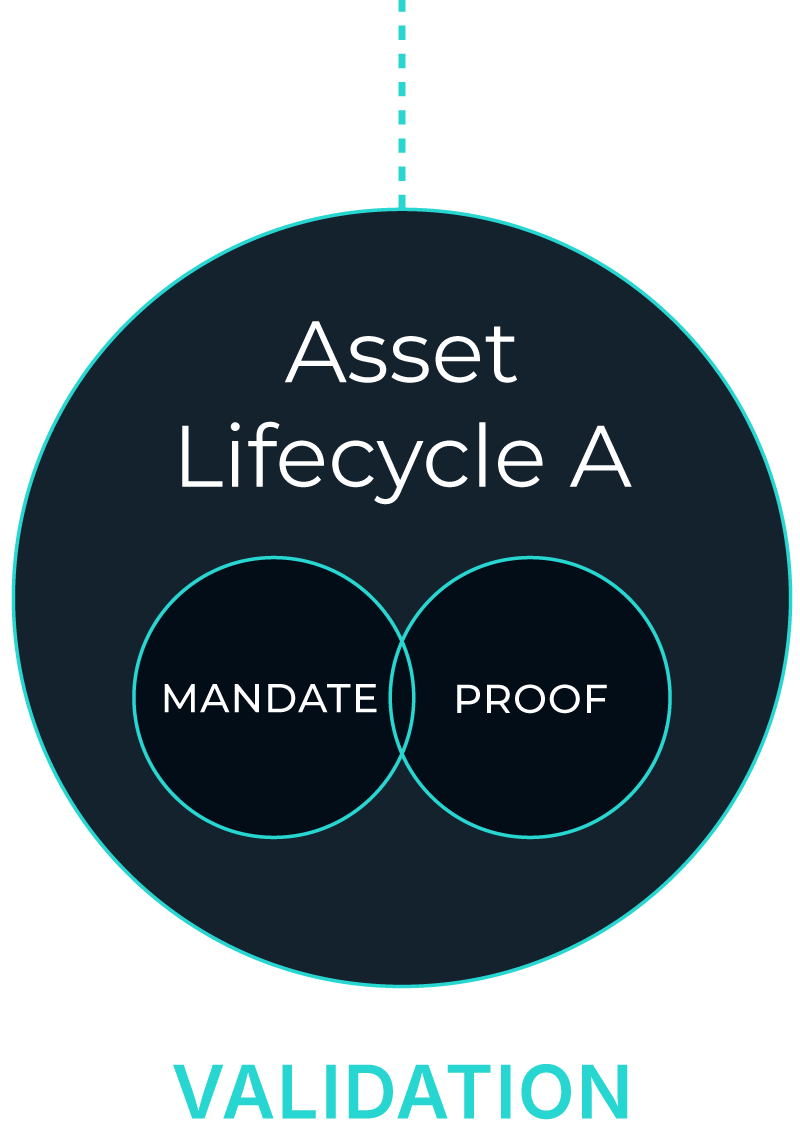

Seeded by a library of standardised constraints, it translates the conditions that define how an asset must perform - return thresholds, covenant structures, risk tolerances and technical standards - into executable logic bound to the asset’s digital state.

Execution is enforced at every state transition. Deviations from the compiled logic are surfaced and either blocked by the rail or routed for an explicit, priced override.

What this means in practice

A fund manager defines their mandate. The conditions they set are enforced from sourcing through disposal without being reinterpreted at every lifecycle state transition.

A developer submits evidence of a completed milestone and sees immediately whether the conditions have been satisfied.

A lender monitors covenant compliance against verified state that updates continuously.

An operator manages day-to-day building performance against defined technical, operational and regulatory conditions. Departures from actuals surface immediately.

A buyer at disposal reads the asset’s complete verified history instead of reconstructing it from scratch.

S Y S T E MThe System

Three layers bind asset state to execution logic across the lifecycle:

-

A canonical, append-only record linking asset, financial, technical, operational and contractual state. Every material state change is timestamped, attributable, and replayable.

This is the Golden Thread.

-

Fiduciary, technical, operational and regulatory conditions are compiled into executable constraints bound to the lifecycle rail. Actions and state transitions are permitted only if compiled conditions are satisfied by proof, or if an explicit, priced override is recorded and propagated.

Compiled constraints replace discretionary interpretation at the execution layer.

-

Distributed infrastructure enforcing deterministic execution and replayability across assets and portfolios. Feasibility logic, verification standards and coordination rules compound into shared constraint libraries, converting project-specific coordination cost into persistent system memory.

Marginal cost collapses as assets accumulate on the rail.

-

The initial system proves deterministic lifecycle execution across multiple real assets under live economic conditions: compiled conditions, proof-gated state transitions, and override propagation enforced through the rail.

S T A G EBuild

We are moving from four years of cross-disciplinary research, spanning building engineering, institutional underwriting, lifecycle execution and system design, into a 3-6 month core build.

We are solving for state machine design and protocol-level infrastructure that can bridge the gap between physical reality and digital logic.